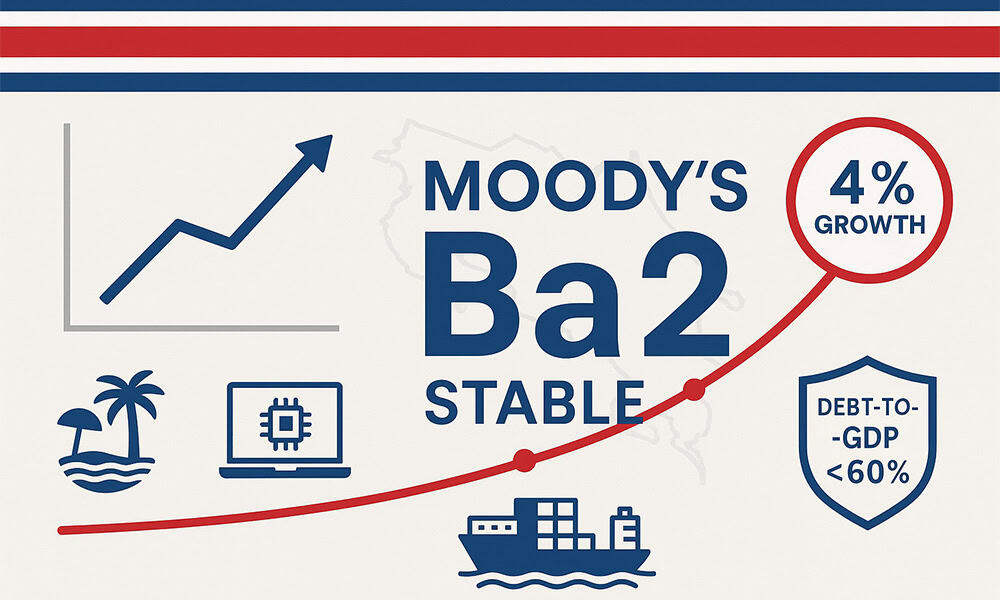

Costa Rica’s credit rating just got a boost from Moody’s, moving up to Ba2 with a stable outlook. This change points to stronger handling of government finances and debt, which could mean good news for our country’s economy.

The upgrade comes after years of tight budget controls and steady growth. Officials have stuck to spending limits, making debt easier to manage. Interest payments on that debt are starting to drop, even as the economy expands. This year, growth is expected to hold around 4%, helping reduce the overall debt load relative to the size of the economy.

This matters in practical ways. A better credit score for our country often leads to lower borrowing costs. That frees up money for public services, infrastructure, and programs that support tourism and daily life. Roads, healthcare, and safety measures could see improvements, making travel smoother and expat life more reliable.

The government has focused on efficient debt strategies, like swapping high-interest loans for cheaper ones. This approach has cut down on financial pressure without raising taxes sharply. Combined with a growing economy driven by exports, tech, and tourism, it sets a positive path forward.

While challenges remain, such as global economic shifts or natural events, the current trends show progress. Debt as a share of GDP is projected to fall below 60% in the coming years if discipline continues. This stability attracts investors, which in turn creates jobs and supports local businesses.

The colon has also held steady against the dollar, and property values in popular spots like Guanacaste or San Jose could benefit from increased confidence. Overall, this step forward reflects hard work in fiscal management. It positions Costa Rica as a more secure spot in Central America.