Nearly 200 products included in Costa Rica’s canasta básica, a grouping of essential goods, are more expensive as of July 1.

The Finance Ministry now charges a 1% value added tax (VAT) on some 195 products — including rice, beans, coffee, meat, milk and cheese, and select personal hygiene items.

The new VAT is the product of the 2018 fiscal reform, which passed after mass protests led by the Costa Rican public sector and is meant to curtail a growing national deficit.

Previously, the canasta básica had been tax-free as part of the country’s General Sales Law, which has since been replaced by the VAT framework.

The 1% VAT on essential goods is valid for at least one year; the Finance Ministry will later decide the tax amount for a five-year period beginning July 1, 2022.

The canasta básica contains basic goods used to measure poverty levels. Someone who can’t afford the basic food basket is considered to be living in extreme poverty.

Tourism services now taxed

The tourism sector is also impacted by new taxes.

According to the Finance Ministry, travel and tourism operators that are registered with the Costa Rica Tourism Board (ICT) must charge and declare a 4% VAT on services until June 30, 2021.

The fiscal reform law indicates this tax would double in 2021 and reach a 13% VAT in 2022.

Not all travel and tourism operators are registered with the ICT. However, unregistered companies have been subject to the full 13% VAT on services since mid-2019.

The tax comes despite protests from the Costa Rica Tourism Chamber (CANATUR), which had asked for a yearlong delay in the face of the coronavirus pandemic.

Online services taxed next month

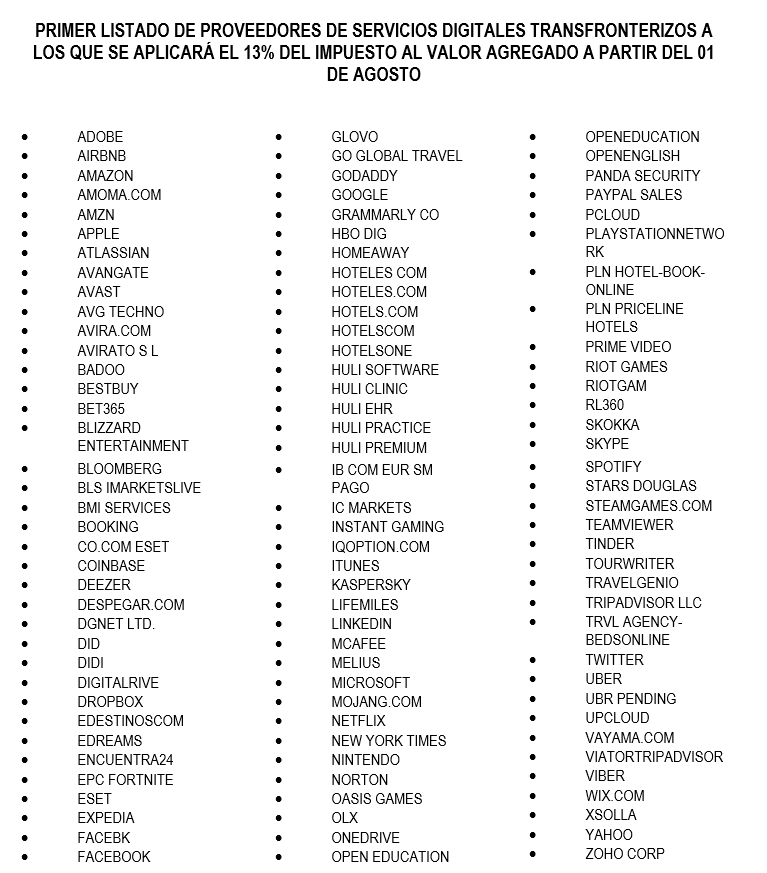

As we previously reported, dozens of trans-national digital platforms will be subject to a 13% value-added tax (VAT) in Costa Rica beginning August 1.

Popular platforms such as Netflix, Uber and AirBnB will all be taxed when selling services that are consumed in Costa Rica.

The full list of online services subject to the VAT as of August 1 is below:

The Costa Rican government says it will update the list of taxed services every six months.