Dozens of trans-national digital platforms will be subject to a 13% value-added tax (VAT) in Costa Rica beginning August 1.

Popular platforms such as Netflix, Uber and AirBnB will all be taxed when selling services that are consumed in Costa Rica.

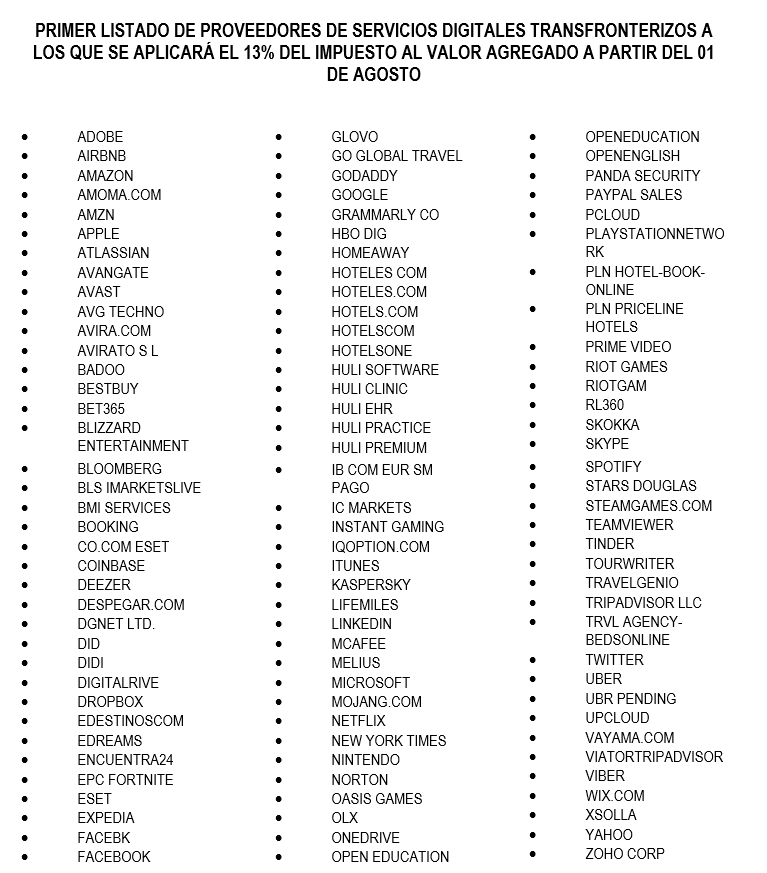

The full list of online services subject to the VAT as of August 1 is below:

The Costa Rican government says it will update the list of taxed services every six months.

The cost of the VAT will largely be passed on to the consumer. In an example provided by Casa Presidencial, a $10 monthly Netflix subscription would cost $11.30 beginning in August. The VAT would either be collected by Netflix or by the credit/debit card issuer.

“In the event that the digital service provider chooses to collect the tax directly, it must register as a taxpayer with the Tax Administration, following the procedure established in resolution DGT-R-13-2020,” the Presidency said in its statement.

The VAT must be declared monthly to the Finance Ministry through form D-188 (for service providers) or D-102 (for card issuers).

Replacing a general sales tax with a more comprehensive VAT was a primary tenant of the fiscal reform that passed in December 2018 after widespread protests.

While public-sector unions argued the new tax law places undue burden on the lower and middle classes, President Carlos Alvarado and others said fiscal reform was necessary to prevent an economic crisis.

Read the official documentation from the Finance Ministry here.