The night that Uber started offering its ride-hailing service in Costa Rica, vandals – reportedly taxi drivers – smashed the windows of one of the company’s cars in protest. Traffic police impounded two Uber vehicles earlier that same night.

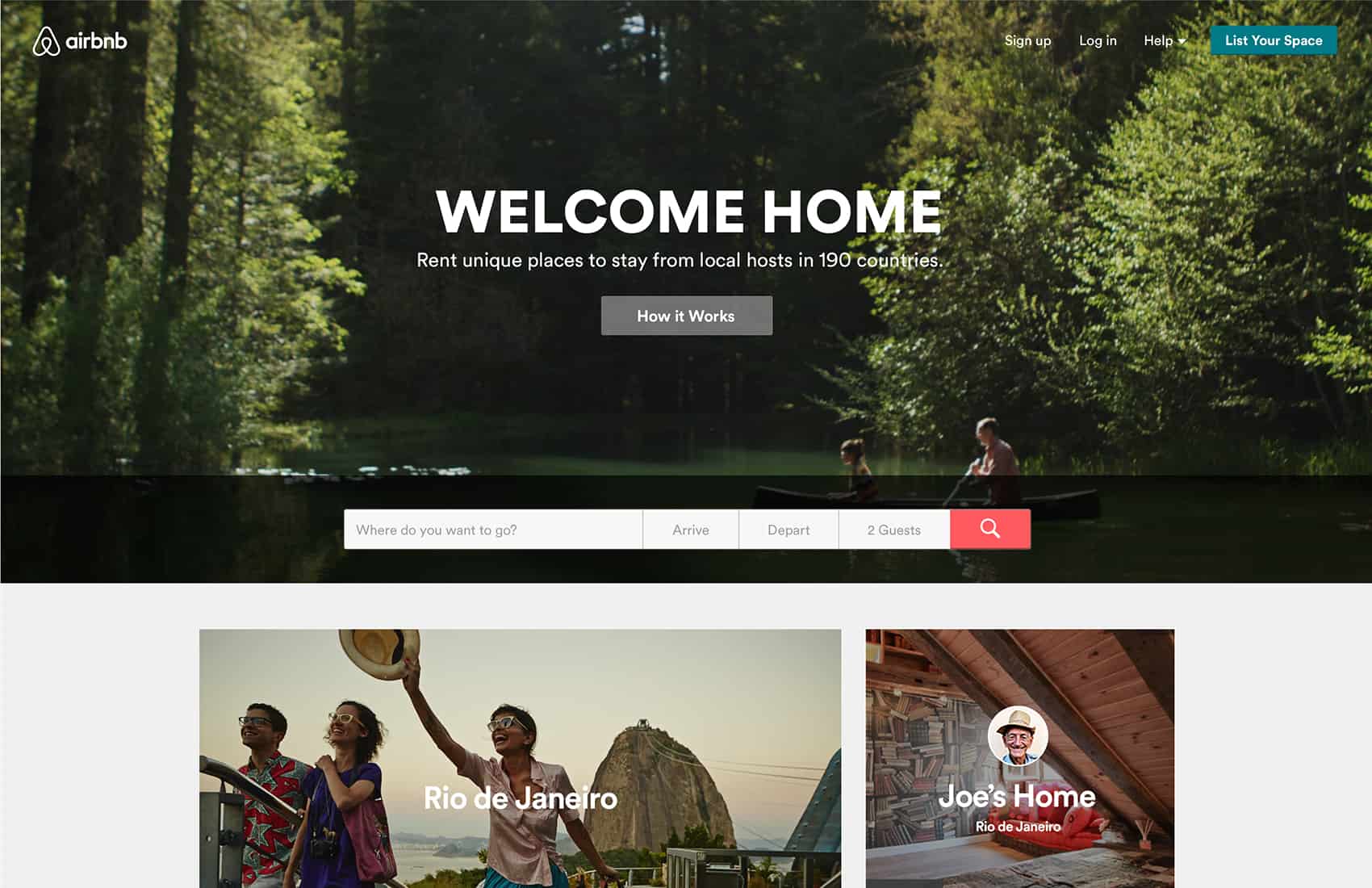

Airbnb, however, another staple of the so-called “sharing economy,” has been operating quietly in Costa Rica without incident for years.

Countries around the world are scurrying to update their laws to address disruptive services like Airbnb and Uber, but the response from the government here has been mixed. The Solís administration has declared Uber’s service illegal and threatened to fine chauffeurs caught driving passengers. But the administration so far has ignored Airbnb, a service that allows private citizens to rent out their homes to guests.

That could change if the Costa Rican Chamber of Hotels can convince the Finance Ministry to go after home-share hosts for tax evasion.

Uber might only be in San José so far, but Airbnb listings are all over the country. Steve Andrews rents a one-bedroom apartment through Airbnb and FlipKey, a similar service offered by popular travel website TripAdvisor, in the Pacific beach town of Tamarindo. Andrews said that he and his wife started listing the property in March and have been booked nearly every night since.

“It’s a good service. It helps us with the bills every month,” Andrews said. “We didn’t think we’d like it at first, but it’s nice having guests in.”

Andrews said he plans to report any income from Airbnb, but other hosts contacted by The Tico Times would not comment about the service because they did not want to pay taxes associated with it. Andrews said he intended to meet with a tax lawyer about what his obligations — if any — would be as a host.

Airbnb tax obligations? Anyone?

The question over what tax obligations sharing economy participants owe is not well defined in Costa Rica. Gustavo Araya, president of the Costa Rican Chamber of Hotels, told The Tico Times that hotels don’t oppose Airbnb, VRBO or other home-sharing services.

“In comparison with the taxis, we here at the Chamber [of Hotels] are lovers of the free market. We can’t oppose an innovation that has already arrived and arrived to stay,” Araya said.

Araya said that the chamber position is that hosts should be able to keep using these services, but any income should be subject to a sales tax, the same 13 percent that hotels must pay.

“Airbnb is a private company that charges commissions, and the owners of these condominiums get profit too,” Araya said. “Any business needs to pay taxes.”

Airbnb charges a value-added tax on its service fees in the EU, Switzerland, Norway, Iceland, and South Africa. Costa Rica is not one of those countries, but the Finance Ministry here has yet to request it, according to Taxation Director Carlos Vargas.

Vargas told The Tico Times that the Finance Ministry is reviewing how and what it would tax Airbnb, and possibly Uber, too. Vargas said the Finance Ministry is still mulling over whether it would ask hosts or Airbnb to withhold the tax.

“The point that needs to be clarified is who generates the income that needs to be taxed and in what form they would need to pay those taxes,” Vargas said.

The director said the government did not share the Hotel Chamber’s assessment that Airbnb and other services were guilty of tax evasion. He said that a crime like tax evasion would have to be assessed on a case-by-case basis, and he could not comment on all users.

One major difference between Airbnb and Uber is that there is no law limiting the number of hotels in Costa Rica. The transit law restricts the number of registered taxis to 13,000 in the San José greater metropolitan area. Hotels and motels are supposed to register with the health and finance ministries, as well as their local municipality, but anyone with the means and the proper authorization can legally operate a hotel.

Smaller hotels also have taken to listing their rooms on Airbnb alongside hosts like Andrews, something that taxi drivers cannot do with Uber. Hotels or hostels might not be the desired hosts for home-sharing services, but in the meantime, they have found a way to use the service instead of fighting it.