Costa Rica’s insurance market offers a wide variety of options for those who wish to acquire insurance coverage. To find the right product, it is very important to be advised and guided by an expert in the field, who is able to help determine which option is the best for every particular case.

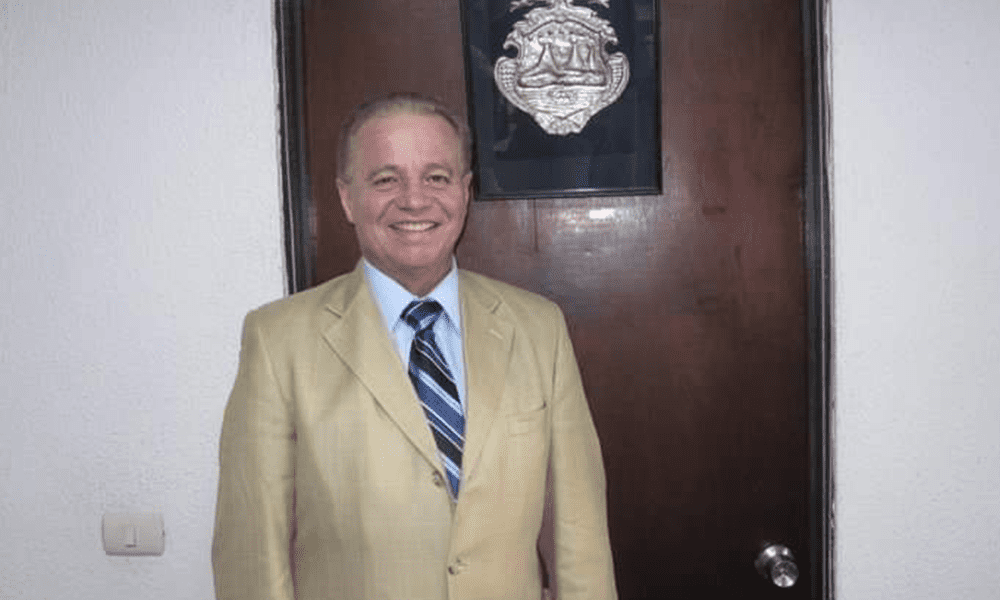

This is, precisely, why Walter Fernández is the best option when considering buying any kind of insurance policies.

Who is Walter Fernández?

Walter Fernández has been in the Insurance business in Costa Rica for 26 years. He is a founding partner of Prisma Corredora de Seguros, an insurance brokerage that has been in the market for 26 years; it is also one of the top companies in the industry. Currently, Prisma has about 72000 customers.

As part of his academic curriculum, he is a Bachelor of Science from the University of Florida and an MBA by the Latin University of Costa Rica.

In addition, Walter Fernández is duly licensed by The Superintendence of Insurance of Costa Rica, which is the entity in charge of monitoring all the activity regarding insurance.

He is fully bilingual, Spanish-English, allowing him to communicate adequately and efficiently with all his clients, via email, phone, online meetings or in person.

What products does he sell?

Insurance broker, Walter Fernández, sells all available products, from all the companies registered and authorized to sell insurance in Costa Rica.

Nevertheless, there are 4 main areas part of his portfolio:

- Property Insurance

- Casualty Insurance

- Health Insurance

- Life Insurance

Property insurance

Property insurance property protection coverage or liability coverage for property owners.

In Costa Rica, this type of insurance is particularly important, because it is a seismic country and – given its weather – it is also prone to natural disasters such as landslides or flooding.

This type of insurance also includes coverage in case of fire.

On the other hand, this insurance provides financial reimbursement to the owner or renter of a property in case of robbery or theft.

Property insurance includes a number of policies, such as homeowner’s insurance, flood insurance, fire insurance among others.

Casualty insurance

Casualty insurance policies include liability coverage to help protect anyone who is found legally responsible for an accident that injures another person or causes damage to another person’s possessions. It also comprises vehicle insurance, liability and theft insurance.

This type of coverage includes individuals, professionals and corporations.

Health insurance

Health insurance products have been specifically designed to provide well-being at all times and places, to those who choose to acquire them. They are created taking into consideration the needs and requirements of each person, depending on their life style and life stage.

The insurance premiums and deductibles allow buyers to access broad coverages, as well as great medical attention.

In Costa Rica’s specific case, health insurance is even more important. The country Social Security System is undergoing a huge crisis, which means there are never-ending waitlists and attention is far from being optimal. Buying health insurance, allows the policy owner to access top medical assistance in its home country, as well as abroad.

There are also group policies available, which are specially designed to meet the needs of companies or associations. To be able to opt for this type of policy, a minimum of 5 title holders is mandatory.

They are versatile and can be tailor-made for company’s who have 50 or more insurance title-holders.

Life

The life insurance portfolio contains different products that protect families, loved ones and patrimony. This way, in case of death or permanent illness, the insurance holder and its family will be able to continue through life with more tranquility and will not experience a substantial deterioration of their finances.

It is important to mention, there are several types of life insurance:

- Indexed product: it is a universal flexible life insurance policy that provides protection, with a future investment to develop personal, family or retirement projects.

- Term life: it’s a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term.

- Universal life: it’s a type of permanent life insurance. With a universal life policy, the insured person is covered for the duration of their life, as long as they meet or fulfill the requirements of their policy, to maintain coverage.

Why should you buy life and health insurance?

- To support your family: you can maintain you family’s income and lifestyle, pay off debts, mortgages, and estate taxes, provide funding for your children’s education and cover any further expenses.

- To safeguard your assets: a substantial amount of assets can be transferred to your children and grandchildren or throughout generations.

- Financial coverage: you will have strong financial support during medical emergencies.

- Extra income: to ensure that you have extra income when your earnings are reduced due to a serious illness or an accident.

- Retirement savings plan: to have a savings plan for the future so that you have a constant source of income after retirement.

- To be protected during an emergency: no one ever knows when an emergency will happen, so it’s best to be covered.

If you’re a business owner, why should buy partner life insurance?

Business insurance coverage shelters businesses from losses, due to different events that may occur during the normal course of business.

Unfortunately, there is a 40%-60% chance of a shareholder dying before the age of 65, which is why everyone should be covered.

The Share Purchase and Sale Agreement is a formal agreement between business partner. It enables the sale and purchase of shares and the transfer of business assets in the event of the premature death of one of the business partners.

Moreover, the benefit of the life insurance policy established in the stock purchase and in the sales plan provides the funds to carry out the agreement. It also offers the protection needed until each partner retires or sells his/her company’s shares.

The plan clearly states the way funds and property are managed and transferred after the death of one of the business partners, so you don’t have to worry about what to do in such event and can avoid potential problems. The plan establishes a fair sale value for all shares and assets of the business.

On the other hand, it is very important to note employees can also be insured; in fact, it is fundamental that they are.

Business owners must buy group policies for their employees, given the series of benefits and positive aspects they offer:

- Private health access: employees are able to get great private healthcare, avoiding long waitlists and lines at the Costa Rican Social Security Fund, saving time, money and even the employee’s life.

- Attract and maintain personnel: having private insurance is highly valued amongst employees. It is a benefit every worker enjoys having for themselves and their families, because of all the advantages the insurance offers.

Why choose Walter Fernández?

Buying insurance is crucial for safeguarding your present, your future, your property, your business, your health and your family. Before making such an important decision, you should be properly advised.

Walter Fernández’s experience and expertise guarantees his clients will get the very best attention, high-quality products that satisfy their real needs and adjust to their budget; his one on one meetings allow buyers to dispel uncertainties and get clear-cut responses to make informed choices.

Let him guide you, while you navigate one of the most important purchases. For appointments, general inquires or to buy insurance, please contact Walter Fernández at the phone number (+506) 88100514, or the email addresses wfernandez@segurosprismacr.com or chomafer@gmail.com.