While it’s nearly impossible to master the U.S. tax code, you don’t need to be a guru on the subject to demonstrate to your friends how up-to-date you are. Below are some important tax facts that every American expat living in Costa Rica should know for the current tax season:

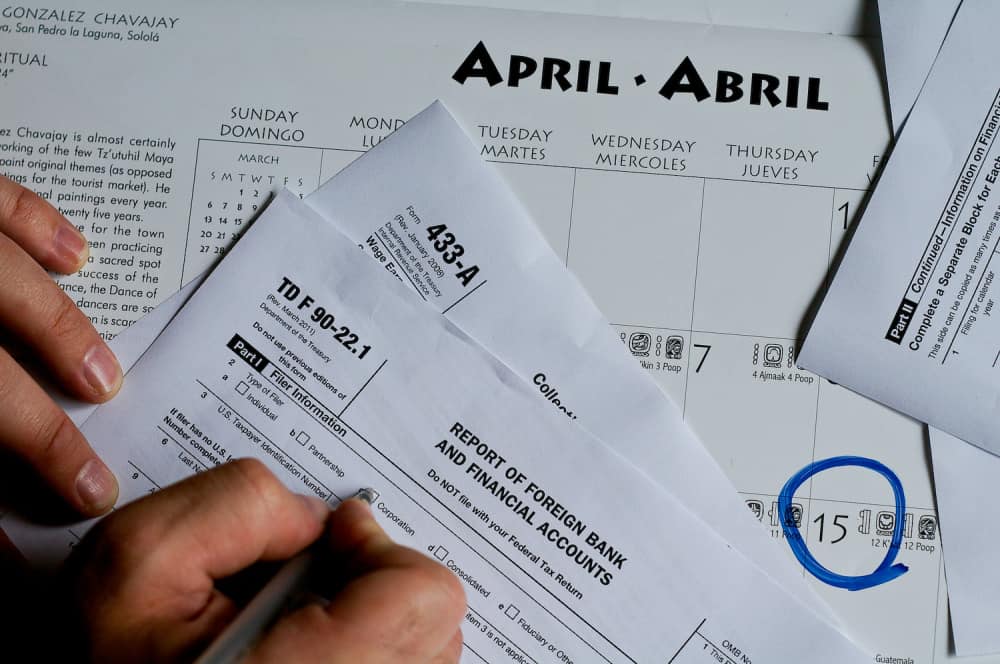

1. Your U.S. federal tax return is NOT due April 15. Yes, that’s right. Expats overseas on April 15 are granted an automatic two-month filing extension until June 15 and, if you need more time, an extension can be filed.

Note that if you owe taxes, you should still make a payment by the U.S. deadline or interest will start to accrue. The regular U.S. tax deadline is actually April 18 this year due to a holiday in Washington, DC. This gives taxpayers three extra days to make a tax payment. Payments can be made online at www.irs.gov/payments.

2. The tax benefits of being overseas have increased and decreased.

Increases: The Foreign Earned Income Exclusion, which reduces your taxable income, increased from $100,800 in 2015 to $101,300 for 2016. If married and both spouses work, each spouse is able to claim the exclusion. In addition, you may also be entitled to the Housing Exclusion which further reduces your taxable income by allowing for a deduction of rental expenses.

Decreases: Beginning with your 2015 taxes, you can no longer claim the additional child tax credit if you claim the foreign earned income or housing exclusion.

3. Reporting of Non-U.S. accounts will change in 2017. FinCEN Form 114, more commonly known as the FBAR, is filed separately from your federal tax return. The FBAR is required if you had over $10,000 among all of your non-U.S. financial accounts at any point during 2015.

Don’t worry: this form does not trigger any taxes. Your 2015 FBAR is due by June 30, 2016 and can be filed online.

Bonus Fact: Starting with your 2016 FBAR, the deadline will change to April 15, 2017 and an extension will be available.

4. Thieves are making it harder to get refunds. Identity theft and tax scams have increased rapidly. Thieves steal taxpayer information and file fake tax returns claiming refunds. To combat this growing problem, the IRS will be validating 20 new pieces of information on tax returns in 2016.

While these extra measures help protect taxpayers, they may also slow the processing of some returns which could mean a delay in issuing refunds. You can check the status of your refund online at www.irs.gov/refunds.

5. Other deductions and credits are available. Don’t forget about potential deductions and credits for college tuition, home energy incentives, traditional IRA contributions and alimony paid. Dependent care expenses may also provide a tax credit which can even include expenses related to a live-in maid if both you and your spouse work.

6. Most expats are exempt from the health care requirement. Also known as Obamacare, the Affordable Care Act requires everyone to have health insurance. The good news is that if you qualify for the Foreign Earned Income Exclusion, you are exempt.

To claim the exemption, file form 8695 with your tax return.

Happy filing!

Kaitlin M. Krozel is a CPA and former expat. Her firm, Krozel Capital, specializes in tax preparation for U.S. citizens living abroad.