Dozens of trans-national digital platforms will be subject to a 13% value-added tax (VAT) in Costa Rica beginning October 1.

Popular platforms such as Netflix, Spotify, Uber and AirBnB will all be taxed when selling services that are consumed in Costa Rica.

Netflix communicated the changes to customers in an email sent this week.

“A value-added tax (VAT) of 13% is scheduled to apply to your Netflix subscription on October 1, 2020. When this change goes into effect, you’ll see the increase in your next billing period as a separate charge on your credit or debit card,” the Netflix email read.

The new tax on online services was initially slated to begin August 1; however, the date was pushed back to October 1 to allow companies time to implement a billing strategy.

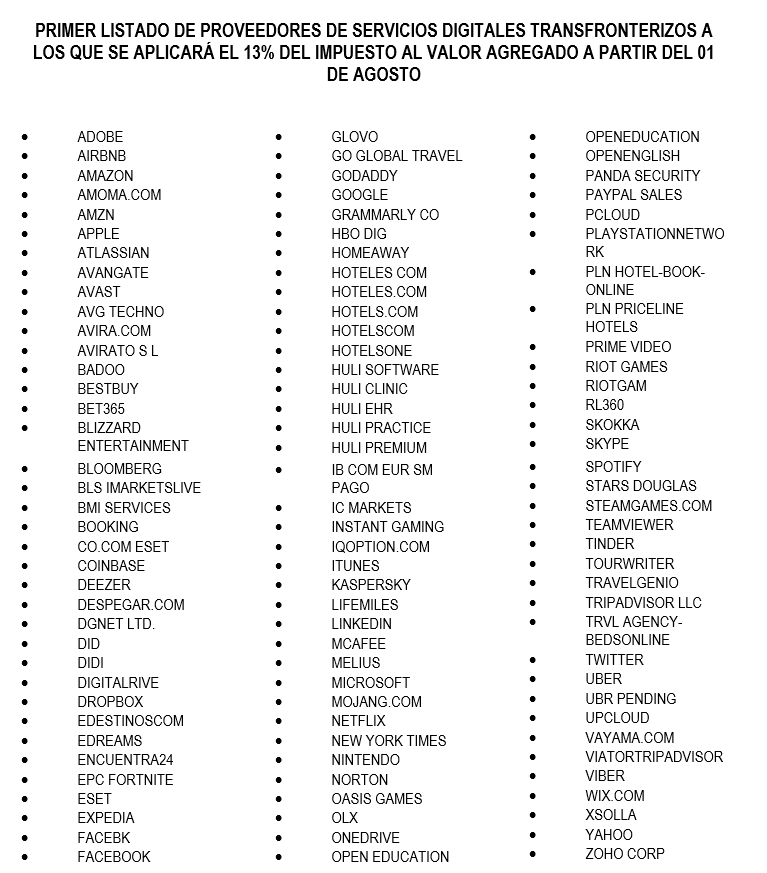

The IVA applies to the following platforms, though the list is subject to change:

The cost of the VAT will largely be passed on to the consumer. In an example provided by Casa Presidencial, a $10 monthly Netflix subscription would cost $11.30 beginning in October.

Replacing a general sales tax with a more comprehensive VAT was a primary tenant of the fiscal reform that passed in December 2018 after widespread protests.

While public-sector unions argued the new tax law places undue burden on the lower and middle classes, President Carlos Alvarado and others said fiscal reform was necessary to prevent an economic crisis.

Read the official documentation from the Finance Ministry here.