The ratings agency Moody Investors Services downgraded Costa Rica’s government bond rating to Ba1 from Baa3 with a stable outlook Tuesday. The decision came weeks after President Luis Guillermo Solís presented his government’s budget for 2015 without any substantial proposals to curb the country’s growing deficit.

Moody’s cited “institutional weakness” and the expectation of continued inaction and growing deficits in the coming years in its explanation why it knocked down Costa Rica’s rating after four years. The agency said that Costa Rica’s inability to reduce its national debt despite several attempts at fiscal reform and the Solís administration’s announcement that it would gradually introduce fiscal consolidation were among the observer’s top concerns.

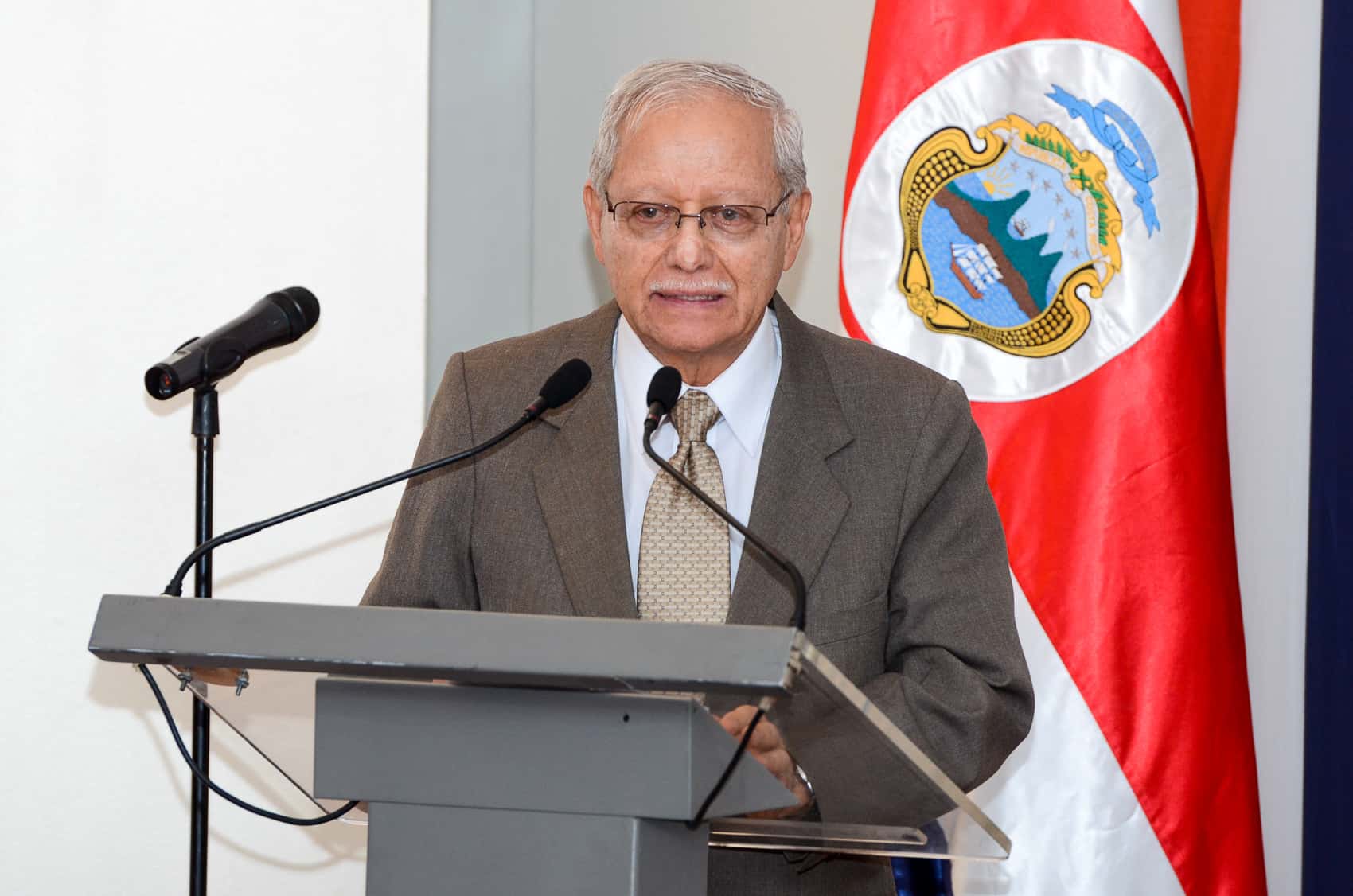

Costa Rica’s fiscal debt has averaged 4.5 percent of gross domestic product since 2009, according to Moody’s. Vice President and Finance Minister Helio Fallas said the government deficit could grow to a projected 6.7 percent of GDP in 2015 – which would be the highest on record – during a budget presentation on Sept. 1.

The ratings agency said that the outlook for the country was stable after the downgrade, and it did not expect further rating changes in the next 12 to 18 months.

Fitch Ratings and other agencies also issued warnings about the direction of the country’s financial well-being.

“The punishment will be seen in higher borrowing costs for the public and private sectors. Getting financing from abroad is going to be more expensive for the government as well as businesses and Costa Rican families because of the loss in confidence in the future ability to pay,” said Luis Mesalles, a Union of Private-Sector Chambers and Associations board member.

Lenders may demand higher interest rates on the $1 billion in Eurobonds mentioned in the 2015 budget. Interest rates already went up during the most recent issue of $1 billion in Costa Rican sovereign debt in April. The government was forced to pay 7 percent interest on the 30-year bonds compared to 5.63 percent on $500 million in Eurobonds auctioned in April 2013.

The Costa Rican Banking Association (ABC) expressed its concern over the rating change, saying action was “urgent” in a statement Tuesday. ABC agreed that the rating change would affect borrowing rates.

Fallas defended the administration’s actions to date, saying the proposed budget assumed there would be no control measures in the coming year. The vice president said there is wide support for a transition to a value-added tax, and he mentioned reforms to the income tax and others in the coming months. The Solís administration took office in May.

“The steps that we’ve been taking are in the right direction, as expressed by the international organizations with whom we met in Washington, but at the same time the ratings agency decided that despite the path this government has begun, at this time they don’t have faith in the efforts of the Legislative Assembly during the last several years,” Fallas said.

Moody’s said structural adjustments to the budget, including increased tax revenues, spending cuts or a combination of both could improve the country’s rating if they were able to get the deficit back in control. While the agency said that the outlook was stable, further inaction could risk additional downgrades in the future.

Fallas said that he hoped the downgrade would serve as a floor for debate and motivate lawmakers to cooperate whenever a fiscal reform package finally reaches the legislature.